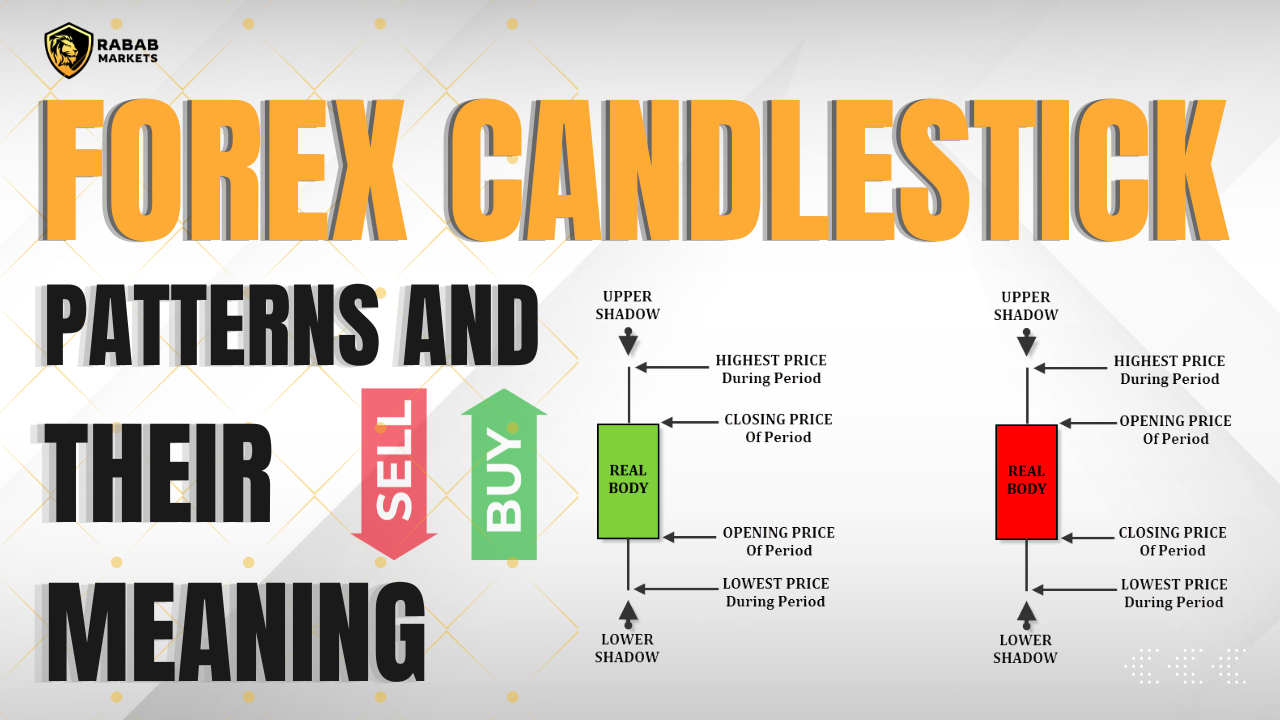

Forex Candlestick Patterns and Their Meaning

As a forex trader, understanding candlestick patterns is crucial for making informed trading decisions. Candlesticks not only provide insight into price movements but also help traders predict potential market reversals or trends. In this blog post, we’ll explore some of the most popular forex candlestick patterns and their meanings, so you can enhance your trading strategy.

1. Doji Pattern

The Doji candlestick signifies indecision in the market. It forms when the opening and closing prices are virtually the same. A Doji can signal that a trend is losing momentum, and a reversal might be near. It’s essential to look for confirmation from subsequent candles before acting.

Meaning: Market indecision, potential reversal signal.

2. Engulfing Pattern

The Engulfing pattern consists of two candlesticks—one small and one large—that “engulf” the previous one. The pattern can appear as either a bullish engulfing (when a larger green candle follows a smaller red one) or a bearish engulfing (when a larger red candle follows a smaller green one).

Meaning: Potential reversal or continuation depending on trend direction.

3. Hammer and Hanging Man

Both the Hammer and Hanging Man patterns have small bodies and long lower wicks. A Hammer occurs at the bottom of a downtrend, suggesting a potential bullish reversal. A Hanging Man appears at the top of an uptrend, signaling a possible bearish reversal.

Meaning: Reversal patterns, depending on trend direction.

4. Morning Star and Evening Star

These three-candle patterns are powerful indicators of trend reversals. The Morning Star signals a bullish reversal after a downtrend, while the Evening Star suggests a bearish reversal after an uptrend.

Meaning: Trend reversal; Morning Star (bullish) and Evening Star (bearish).

5. Shooting Star

The Shooting Star has a small body with a long upper wick, and it forms after an uptrend. This pattern indicates that the bulls lost momentum and the bears might take control.

Meaning: Bearish reversal signal after an uptrend.

Why Candlestick Patterns Matter for Forex Traders

Understanding these candlestick patterns is essential for successful forex trading. At Rabab Markets, we provide our clients with the tools and resources to stay ahead in the market. By learning to spot these patterns early, you can improve your ability to predict market movements and enhance your trading decisions.

Improve Your Trading with Rabab Markets

Whether you’re a beginner or an experienced trader, Rabab Markets is here to support your trading journey. Our advanced platform, comprehensive guides, and customer service ensure that you have everything you need to succeed. Visit rababmarkets.com to open an account today!

Meta Description: Learn about essential forex candlestick patterns and their meanings. Enhance your trading strategy with Rabab Markets, your trusted forex broker.